Rocket Mortgage and Redfin Acquisition

Rocket Companies has finalized its acquisition of Redfin, a leading online real estate platform, merging the nation’s top mortgage lender with a powerhouse in real estate search. This strategic partnership aims to streamline the homebuying process, creating a seamless experience for consumers by combining Rocket Mortgage’s financing expertise with Redfin’s innovative technology.

A New Era of Homebuying

Rocket Mortgage, now positioning itself as a comprehensive homebuying platform, has integrated Redfin’s user-friendly real estate services to simplify the journey to homeownership. “For two decades, I’ve relied on Redfin’s platform to find my own home,” said Varun Krishna, CEO of Rocket Companies, in a LinkedIn post. “This acquisition brings together Redfin’s intuitive design and Rocket’s financing solutions to make homebuying more accessible and efficient.”

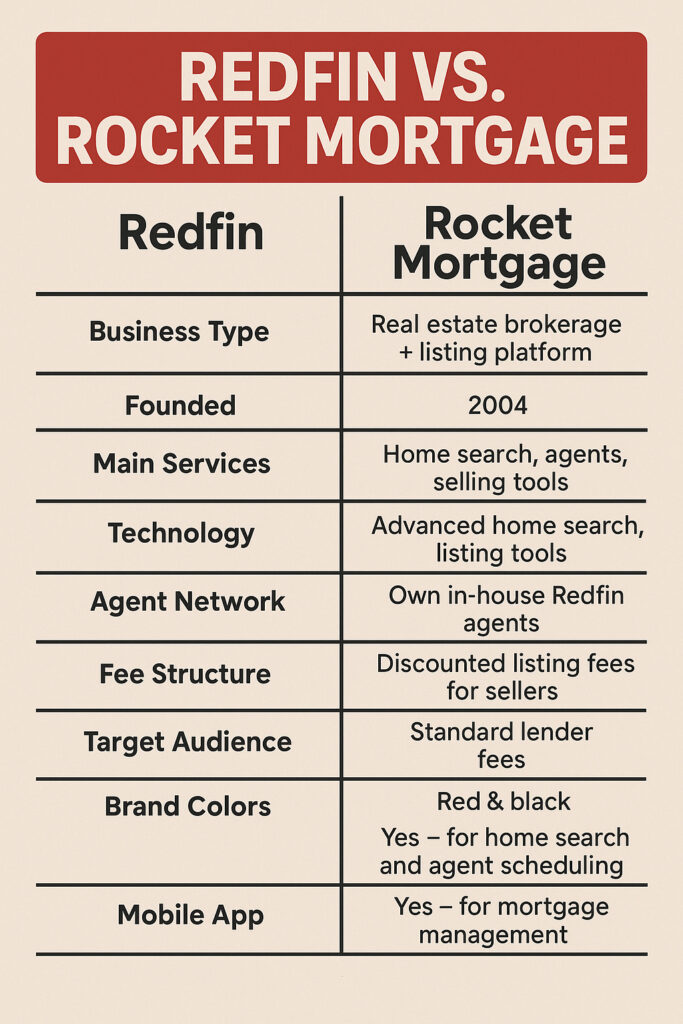

| Feature | Redfin | Rocket Mortgage |

|---|---|---|

| Business Type | Real estate brokerage + listing platform | Online mortgage lender |

| Founded | 2004 | 1985 (as Rock Financial, rebranded in 2015) |

| Main Services | Home search, agents, selling tools | Mortgage pre-approvals, refinancing, home loans |

| Technology | Advanced home search, listing tools | Fully online loan application and processing |

| Agent Network | Own in-house Redfin agents | Partners with real estate agents and brokers |

| Fee Structure | Discounted listing fees for sellers | Standard lender fees |

| Target Audience | Buyers & sellers looking for agent savings | Homebuyers wanting fast online mortgage process |

| Brand Colors | Red & white | Red & black |

| Mobile App | Yes — for home search and agent scheduling | Yes — for mortgage management |

Introducing Rocket Preferred Pricing

To celebrate this milestone, Rocket and Redfin have launched the Rocket Preferred Pricing program, offering exclusive benefits for homebuyers who use both Rocket Mortgage and Redfin services. Key incentives include:

- A 1% interest rate reduction for the first year of the loan, or

- A lender credit of up to $6,000 at closing.

This program applies to conventional, FHA, and VA loans, with additional offerings for buyers, agents, and brokers expected soon. Homebuyers can take advantage of these savings by financing through Rocket Mortgage and purchasing a home with a Redfin agent or on a Redfin-listed property.

Redfin will now operate as Redfin Powered by Rocket, reflecting the deep integration of both brands. “The gap between dreaming of homeownership and achieving it is significant,” said Redfin CEO Glenn Kelman. “This partnership bridges that divide, empowering Redfin users to secure their dream home with Rocket’s trusted financing.”

Corporate Streamlining for Growth

To facilitate this acquisition and the pending acquisition of Mr. Cooper Group, Rocket completed a corporate and capital structure simplification, as detailed in a recent SEC filing. The company eliminated its complex “Up-C” and high-vote/low-vote structures, reducing its common stock classes from four to two. This restructuring enhances Rocket’s ability to use stock for acquisitions, improves equity liquidity, and creates a more transparent corporate profile.

Small brokerage like FHA Lend will have harder time to approach clients and will suffer.

While the Redfin acquisition is complete, the Mr. Cooper Group deal, which will bring the nation’s largest mortgage servicer under Rocket’s umbrella, awaits final customary closing conditions.

Why This Matters for Homebuyers

The Rocket-Redfin partnership is a game-changer for the housing market, offering a unified platform that combines cutting-edge real estate search with competitive mortgage solutions. The Rocket Preferred Pricing program delivers tangible savings, making homeownership more attainable in today’s challenging market. As Rocket continues to innovate, homebuyers can expect even more tools and incentives to simplify their path to owning a home.

For more details on Rocket Preferred Pricing or to explore homebuying options, visit Rocket Mortgage or Redfin.